Expanding your business internationally can open new revenue streams—but navigating international shipping duties and taxes can be a challenge. Freight Right offers the only all-in-one, end-to-end, merchant-centric logistics solution tailored to streamline taxes, compliance, and duties in new markets. Our team of experts helps you minimize costs and maximize margins with precision and efficiency.

Compliance shouldn’t slow you down. Freight Right ensures your business stays ahead by:

Identifying government restrictions on transactions.

Providing power of attorney for merchants.

Automating tariff code classification for accurate duties.

With Freight Right, you can enter new markets confidently and efficiently.

Our specialists maximize your bottom line by optimizing product HS codes to minimize duty payments. We:

Analyze your product classifications.

Recommend tariff codes to lower duties.

Keep you updated with changes in global trade policies.

Let us handle the complexities while you focus on scaling your business.

Calculating and paying international taxes and duties collections and remittances correctly is challenging for merchants. Freight Right's team is here to make sure you're paying the lowest amount, on time and to the right authorities while you focus on growing your business in a new market.

Taxes shouldn’t be guesswork. Freight Right automates and calculates VAT, GST, customs duties, sales, and use taxes with accuracy. With our support, tax compliance becomes a seamless part of your international expansion. We:

Provide real-time duty and tax estimates.

Simplify your tax reporting processes.

Help you avoid costly errors or delays.

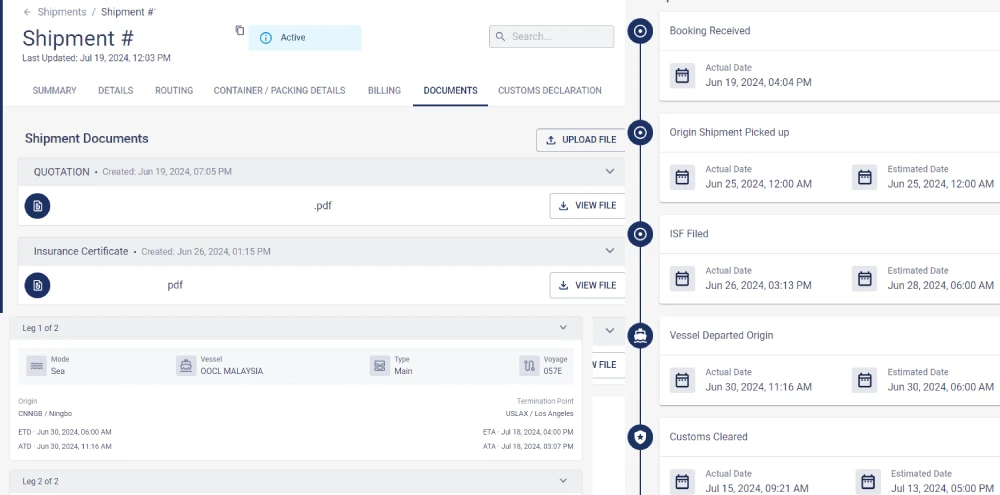

Our end-to-end logistics solution focuses on your success. Freight Right ensures your logistics support is always one step ahead:

Manage every detail of shipping, from duty remittance to customs clearance.

Gain full transparency with real-time tracking and updates.

Save time and money with our tailored solutions for merchant needs.

There are many greate freight forwarders. There are many great technology companies. Freight Right is the best of both.

Book a call today with our team to discuss how Freight Right can help with your international eCommerce operations.

Duties and taxes are fees imposed by governments on imported goods. These charges vary by country and are used to regulate trade and generate revenue.

Customs duties are taxes on goods imported into a country. Taxes, such as VAT or GST, are additional fees charged at the point of sale. Tariffs are a type of customs duty applied to specific products.

Duties and taxes are typically calculated based on the declared value of goods, shipping costs, and product classification (HS codes). Rates depend on the destination country and product type.

The cost varies depending on the destination country, product classification, and applicable trade agreements. Freight Right provides precise estimates for every shipment.

In most cases, the importer or recipient is responsible for paying duties and taxes. Freight Right can help you navigate payment processes to ensure compliance.