On September 13, 2024, the Biden Administration announced significant changes to the de minimis rule for low-value imports, particularly targeting goods affected by tariffs under Sections 301, 201, and 232.

These changes are expected to have a wide-ranging impact on businesses, especially those importing goods from China, steel, aluminum, and other industries subject to the tariffs.

Increased documentation requirements and stricter enforcement of existing regulations may further complicate the process for companies relying on the de minimis exemption.

Shippers should prepare for heightened compliance obligations and potentially increased costs ahead of the holiday season.

The Biden Administration’s executive action introduces substantial modifications to the de minimis rule, marking one of the most significant shifts in trade policy in recent years. Historically, the de minimis exemption allowed for goods valued at less than $800 to enter the U.S. duty-free, providing a critical avenue for businesses to import products at a reduced cost.

This exemption also alleviated the administrative burden of extensive paperwork typically required for standard shipments. For many, the de minimis threshold became a cornerstone of their supply chains, particularly for low-value, high-volume e-commerce shipments.

Under the new executive action, products that fall under Section 301, Section 201, and Section 232 tariffs will no longer qualify for the de minimis exemption.

The most significant impact will be felt by businesses importing Chinese goods, given that the Section 301 tariffs—originally enacted during the Trump administration—target approximately 85% of imports from China.

These tariffs were implemented in response to what the U.S. government views as unfair trade practices, such as intellectual property theft and forced technology transfers. The inclusion of Section 301 duties in the new de minimis rule effectively eliminates the duty-free treatment for a wide array of Chinese-made products, ranging from consumer electronics to textiles.

Section 201 tariffs, which focus on safeguarding injured domestic industries, and Section 232 tariffs, aimed at protecting national security, are also brought under the purview of this new policy. These sections have imposed duties on items such as solar panels, washing machines, steel, and aluminum products. Businesses importing any of these goods will now face the same documentation and compliance requirements as they would for higher-value shipments.

Moreover, the administration has announced its intention to fast-track these changes through a Notice of Proposed Rulemaking. While this process typically involves public feedback and can take several months, there are indications that the White House is eager to finalize the rules in time to impact the upcoming holiday season. If implemented by November 2024, these changes could disrupt the flow of last-minute imports, particularly those relying on the de minimis threshold for cost efficiency.

The rulemaking process, while a standard procedural step, highlights the administration’s commitment to enforcing these changes quickly. Executive branch agencies can modify their interpretation and enforcement of laws without requiring Congress to pass new legislation. This speeds up implementation, though it also opens the door to legal challenges, especially from pro-trade groups likely to contest the changes under the Administrative Procedure Act. These groups may attempt to delay or weaken the enforcement of the new rules.

Despite the significant changes in eligibility for de minimis treatment, some key aspects of the rule remain intact.

The requirement that the recipient of the de minimis shipment must be clearly identified stays the same. This has long been a point of emphasis for U.S. Customs and Border Protection (CBP), which has pushed for greater transparency in identifying the individuals or entities claiming the exemption. The new rules will codify what has been CBP’s practice, making enforcement of this requirement more formalized.

The 10-digit Harmonized Tariff Schedule (HTS) classification requirement for certain types of de minimis shipments also remains unchanged. For example, Type 86 (T86) entries, a specific kind of de minimis entry, already require detailed reporting at the 10-digit HTS level for admissibility and reporting to Partner Government Agencies (PGAs). This level of classification, while potentially burdensome for some shippers, was already mandated in many cases and will continue under the new regime.

Goods that are already excluded from de minimis treatment, such as those subject to Anti-Dumping or Countervailing Duties (ADD/CVD), will not see changes under the new rule. These duties apply to goods that are being sold in the U.S. at less than fair market value or are subsidized by foreign governments, and they have long been outside the scope of the de minimis exemption.

The administration has also left room for Congress to pass additional legislation that could further refine or expand these changes. Several bills, such as the Import Security and Fairness Act and the End China’s De Minimis Abuse Act, have already been introduced in Congress. These proposals aim to close perceived loopholes in the current system, particularly regarding imports from China. While the executive action accelerates some changes, it is clear that further legislative developments could reshape the de minimis landscape even more dramatically in the future.

The new de minimis rules will have far-reaching implications beyond simply excluding certain goods from duty-free treatment.

Shippers will also face a host of new compliance requirements and documentation burdens. One of the most significant changes is the expected increase in reporting data for all de minimis entries. CBP is likely to require more detailed information about the supply chain participants involved, including the manufacturers, sellers, and consignees of imported goods. This push for transparency is part of a broader effort to crack down on fraudulent imports, intellectual property theft, and the use of forced labor.

Another critical area of concern is the enforcement of the Uyghur Forced Labor Prevention Act (UFLPA). CBP is expected to ramp up its efforts to block shipments suspected of violating this law, which bans the importation of goods made with forced labor from China’s Xinjiang region. The new de minimis rules will likely see enhanced scrutiny of supply chains, with CBP conducting more audits, inspections, and verifications. For businesses that rely on imports from China, particularly those in industries like apparel and electronics, the risk of shipments being delayed or blocked due to forced labor concerns will increase significantly.

Finally, the Consumer Product Safety Commission (CPSC) is expected to tighten enforcement of safety standards for de minimis shipments. Importers will need to file testing certificates or General Certificates of Conformity (GCCs) for consumer products at the time of entry, a requirement that currently applies only when specifically requested by regulators. This change could increase the administrative burden for businesses importing goods subject to U.S. safety standards, particularly in industries such as apparel, toys, and electronics.

As businesses adapt to these new requirements, they should also brace for potential cost increases. The exclusion of many products from the de minimis exemption will lead to higher duty payments, and the added documentation and compliance measures will likely raise operational costs as well. For companies heavily reliant on the de minimis threshold, particularly those engaged in e-commerce, these changes could necessitate a reevaluation of their supply chain strategies in the coming months.

Some exciting news from our corner of the logistics world—our CEO, Robert Khachatryan, has been shortlisted for the The LA Times Studios - LA Executive Leadership Awards.

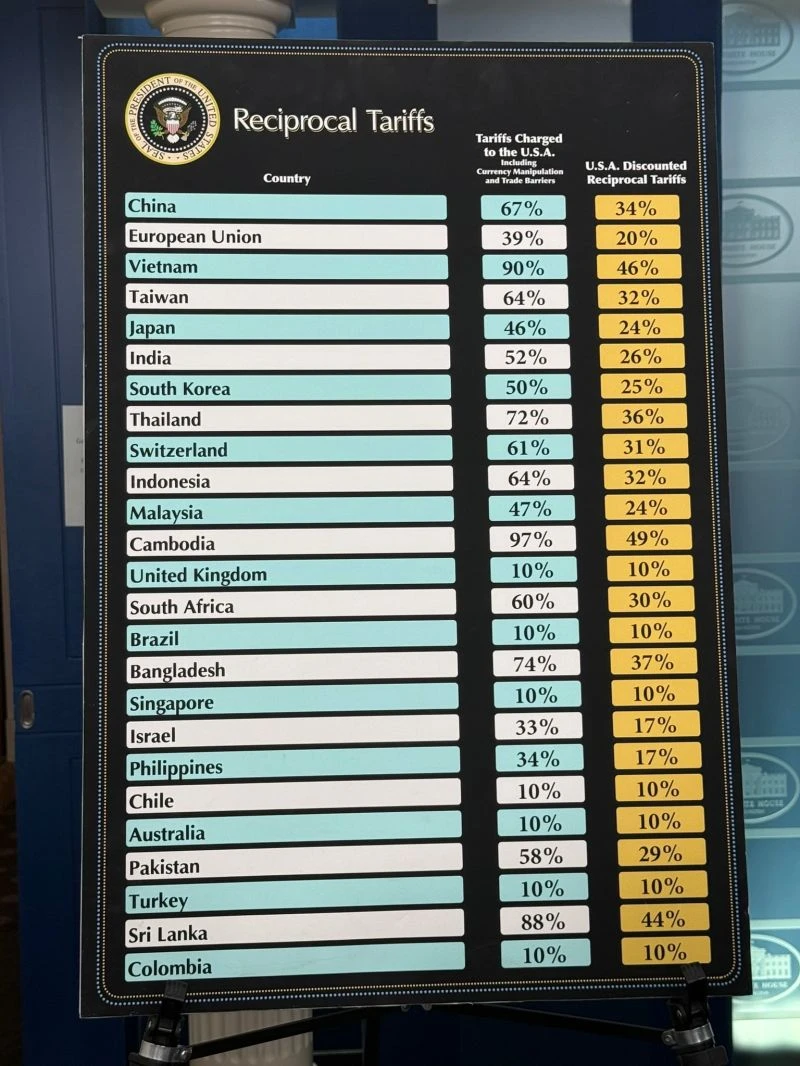

On April 2nd, the Trump administration announced reciprocal tariffs aimed at 50 countries and a baseline 10% tariff on all imports to the US. Here are the latest tariffs the US plans to levy against other countries.

The International Longshoremen's Association began their strike October 1, 2024, affecting ports running along the east coast and Gulf regions of the United States. See what ports are affected and what this strike can mean for shippers.

The May 21 product exclusion covers 103 separate exclusion requests

A list of strict ATA Carnet accepting-countries and the specifications they hold. Most non-commercial, exhibiting importers and exporters recognize the value and role of ATA Carnets in the complicated field of trade. While the World Customs Organization

The amount of truckers is dwindling and it is not good news for the freight industry. Why is this happening and what are the long and short term solutions?

Learn the top 2 reasons for eCommerce cart abandonment—high shipping costs and slow delivery—and discover actionable strategies to reduce lost sales and boost conversions.

Demurrage and detention fees are mostly avoidable when you use the right solutions and partnerships to help you manage your shipments.

In the hospitality and hotel sectors, the success of a project often hinges on countless elements working together seamlessly. Among these, shipping Furniture, Fixtures, and Equipment (FF&E) plays an integral role, often influencing a project's timeline,

A look into the volatile freight contract season, exploring broken promises, rate surges, and solutions for sustainable agreements through strategic contracting and innovative market practices.