The recently concluded freight contract season, primarily wrapping up in the first two weeks of May, has left a turbulent wake in the shipping industry. This season was marked by an aggressive tug-of-war between forwarders, carriers, and Beneficial Cargo Owners (BCOs). Despite initial appearances of stability with agreed rates around $1550 per container (Asia base ports to US West Coast), the aftermath reveals a landscape fraught with broken commitments, skyrocketing rates, and a palpable tension between key players.

The recently concluded freight contract season, primarily wrapping up in the first two weeks of May, has left a turbulent wake in the shipping industry. This season was marked by an aggressive tug-of-war between forwarders, carriers, and Beneficial Cargo Owners (BCOs). Despite initial appearances of stability with agreed rates around $1550 per container (Asia base ports to US West Coast), the aftermath reveals a landscape fraught with broken commitments, skyrocketing rates, and a palpable tension between key players.

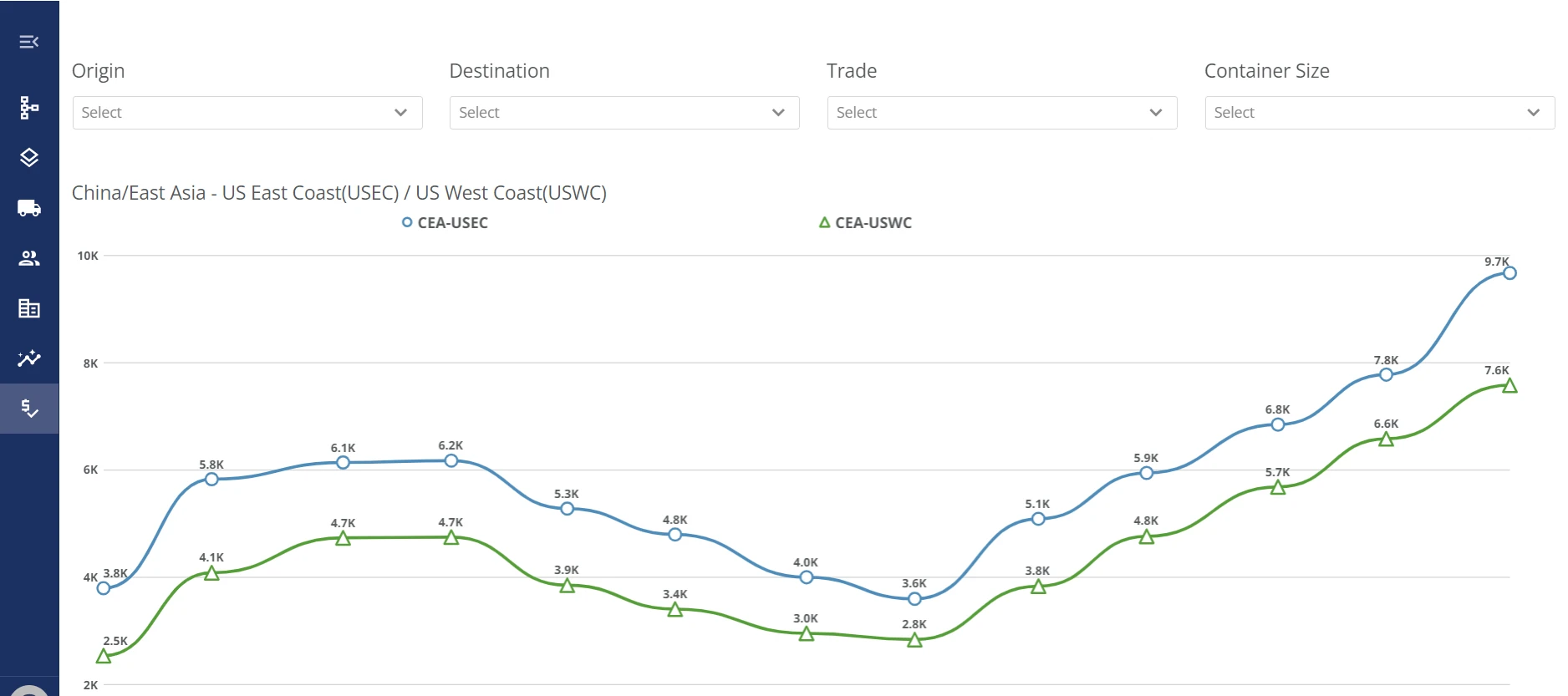

As the dust settled on the contract agreements, it became apparent that many of these commitments were not upheld. Containers that were supposed to move at the agreed-upon low rates did not, as forwarders blamed carriers for not releasing space, while carriers quickly implemented General Rate Increases (GRIs) and Peak Season Surcharges (PSS). This maneuver effectively doubled the Freight All Kinds (FAK) rate from about $3000 in mid-April to an astonishing $6200 by June 1st. The fixed rate also saw a significant increase from $1550 to $2550 per container, not exempt from the PSS which currently stands at $1000 per container.

This abrupt change in rates has significantly disrupted the logistics plans of many companies. Businesses that budgeted for shipping costs based on initial contract rates are now facing unexpected financial strain. The volatility in shipping costs has also led to delays and inefficiencies in the supply chain, as companies scramble to adjust their logistics strategies.

The perpetual conflict between cargo owners and carriers exacerbates this instability. Shippers, particularly large retailers, push for the lowest possible rates, often below carriers' break-even points. Carriers, driven by competitiveness and legal constraints, reluctantly accept these unsustainable rates, only to seek revenge by exploiting market conditions to hike prices whenever possible.

Moreover, the so-called "contracts" in the Asia-North America trade are often nothing more than "Service Agreements" devoid of penalties. When market rates surge, carriers naturally favor moving containers at higher spot rates rather than honoring low-rate agreements. This cycle of mistrust and opportunism leads to a volatile market, where sustainable long-term agreements are elusive.

This environment of mistrust creates significant challenges for the industry. Without genuine partnership and mutual understanding, both shippers and carriers find themselves in a constant battle, each trying to outmaneuver the other. This adversarial relationship ultimately harms the entire supply chain, leading to higher costs and reduced efficiency.

This season has been particularly frustrating due to the prevalence of unrealistic offers. Large forwarders, encouraged by carriers, presented rates at or below publicized levels, creating a false sense of security. These forwarders secured deals under the pretense of later figuring out the logistics, leading to widespread overpromising and underdelivering.

Early in the negotiation phase, it was clear that no significant contracts had been finalized, not even with major players like Walmart or Expeditors. Yet, smaller contracts with rates of $1800 and $2800 for USWC and USEC respectively, while not high, were far more realistic compared to the aggressively low rates offered by larger forwarders.

The deceptive practices during the negotiation phase have left many businesses in a precarious position. Companies that relied on the promised rates now face higher costs and potential delays as forwarders and carriers scramble to honor their commitments. This has led to a breakdown in trust and further complicates future negotiations.

To achieve the best and most sustainable deals for the next 12 months, shippers should focus less on price and more on strategy:

Know the Baseline: The lowest realistic rates hover around $1600/$2700 with a 30/70 ratio commitment of fixed/FAK. Rates significantly lower than this, often near the breakeven point for most carriers, are unfeasible and unsustainable for the market.

Ensure Profitability for Forwarders and Carriers: Both forwarders and carriers need to operate profitably to ensure the reliability and stability of service commitments. Fair profit margins can lead to more reliable service.

Accountability and Performance: Establishing real consequences for non-performance is crucial, even in the face of legitimate geopolitical or economic disruptions. The role of a freight forwarder is to ensure a reliable supply chain despite such challenges, not in their absence. Failure to perform should result in significant repercussions, underscoring the importance of maintaining service standards regardless of external crises. This approach ensures that agreements are adhered to, and that any failure to deliver is met with tangible penalties.

To address the ongoing issues and foster a more stable and trustworthy environment, several solutions can be proposed:

Transparent Contract Terms: Implement more transparent and enforceable contract terms that include penalties for non-compliance. This would ensure that all parties are held accountable and reduce the likelihood of broken commitments.

Collaborative Negotiations: Encourage a more collaborative approach to negotiations. Both shippers and carriers should aim for win-win scenarios where both sides benefit. This can be achieved through open communication and a willingness to understand each other's constraints and needs.

Market Flexibility Mechanisms: Introduce mechanisms within contracts that allow for adjustments based on market conditions. This could include clauses that permit rate adjustments within a defined range in response to significant market changes, ensuring that both parties can adapt without resorting to drastic measures.

Enhanced Industry Regulations: Advocate for stronger industry regulations that promote fair practices and discourage predatory pricing strategies. Regulatory oversight can help maintain a level playing field and protect the interests of both shippers and carriers.

Linking contract rates to a verified index, such as the Freightos Baltic Index (FBX), can help align contracted rates with market movements, reducing the incentive for carriers and shippers to renege on agreements. This approach allows contracted rates to move with the market, removing the motivation for carriers to roll contracted volumes or for shippers to no-show when rates fluctuate. By using real-time data and reliable indices, the industry can adopt multi-year agreements that automatically adjust rates, saving the cost and hassle of annual negotiations. Platforms like Freightos are leading the way in this area, providing valuable tools and data for better contract management and stability.

Freight derivatives, including Forward Freight Agreements (FFAs), offer a way to hedge against price volatility. By engaging in freight futures trading, BCOs can protect themselves from sudden rate changes. If freight rates increase, losses on actual freight purchasing can be offset by gains in derivatives, and vice versa. This strategy involves taking an opposite derivatives position to actual freight purchasing, providing a financial cushion against market fluctuations. This method, demonstrated by the recent landmark futures deal on the Singapore Exchange (SGX) brokered by Braemar Securities, shows promise in managing freight-rate risk effectively.

Freight Right Global Logistics offers Strategic Contracting™, a comprehensive solution designed to provide long-term stability and reliability in the volatile freight market. This approach integrates transparent contract terms, index-linked rates, and the use of freight derivatives to hedge against price volatility. By focusing on fair profit margins and accountability, Strategic Contracting™ ensures that both forwarders and carriers operate profitably while maintaining service commitments. The increasing list of clients opting for this innovative approach reflects a growing recognition of the need to move beyond annual negotiations, embracing sustainable practices that foster trust and cooperation in the logistics industry.

Freight contract season has once again highlighted the fragile nature of agreements in this highly volatile industry. Sustainable partnerships require transparency, fair profit margins, and mutual accountability. By adopting a strategic approach and implementing these solutions—enforcing accountability, index linking, and utilizing freight derivatives—shippers and carriers can navigate these turbulent waters more effectively and secure more reliable and realistic agreements, fostering a healthier and more stable industry landscape.

Today, we're proud to announce Freight Right's proprietary freight rate index, the TrueFreight Index (TFCX). Learn how we built the index. Subscribe to get weekly rate and market updates.

The amount of truckers is dwindling and it is not good news for the freight industry. Why is this happening and what are the long and short term solutions?

Demurrage and detention fees are mostly avoidable when you use the right solutions and partnerships to help you manage your shipments.

Explore the journey from ‘Buy Now’ to your home in our China-US Ocean Freight Shipping Guide. Discover the trade, environmental impact, and future of shipping.

Freight Right is now offering direct consolidated ocean shipments to the Port of Long Beach and Los Angeles.

Learn the top 2 reasons for eCommerce cart abandonment—high shipping costs and slow delivery—and discover actionable strategies to reduce lost sales and boost conversions.

Learn about the most common extra charges on ocean import

“It’s time for updated rules of the road. That’s what this bill does.”

In the hospitality and hotel sectors, the success of a project often hinges on countless elements working together seamlessly. Among these, shipping Furniture, Fixtures, and Equipment (FF&E) plays an integral role, often influencing a project's timeline,