Starting May 2, 2025, nearly all Chinese goods, even small e-commerce shipments valued under $800, will face heavy U.S. duties. Postal imports are hit with either 120% of item value or a flat per-item charge ($100–$200). Carriers must collect and remit duties, and CBP is modifying HTS rules accordingly, according to new guidance released from US Customs and Border Protection.

From the document, starting May 2, 2025, de minimis treatment for PRC/Hong Kong goods entered into the U.S. (except certain postal items) will be eliminated. On June 1, 2025, duties will increase on certain postal items.

No more duty-free treatment under 19 U.S.C. 1321(a)(2)(C) for PRC and Hong Kong products valued at or under $800.

Shipments must be properly entered and duties paid through CBP’s ACE (Automated Commercial Environment).

New Postal Duty Rates for China/Hong Kong Imports: Postal shipments valued ≤ $800 arriving from China/Hong Kong face two options:

120% Ad Valorem Duty (value-based), or Specific Duty:

$100 per item (May 2 – May 31, 2025)

$200 per item (starting June 1, 2025)

Carriers must collect and remit duties on postal imports. Additionally, carriers must have an international carrier bond to guarantee duty payments. Carriers must also consistently use one duty collection method and can only change it monthly with 24 hours notice.

Some shipments may still require formal customs entry even if duties have been prepaid via the postal system. Formal entries will follow normal HTSUS duties and taxes, not the flat postal rate.

On changes to the Harmonized Tariff Schedule (HTSUS):

PRC and Hong Kong goods are officially excluded from de minimis exemptions in HTSUS.

HTSUS Chapter 99 updated to add subdivision (w) clarifying duty treatment for Chinese postal imports.

Drawback (duty refund) is not allowed for these items.

Lastly, these duties apply in lieu of regular Section 301 China tariffs or normal MFN rates. CBP may suspend or amend its regulations temporarily to enforce these measures (such as relaxing entry paperwork requirements). Postal shipments that CBP flags for formal entry will NOT be eligible for the flat postal duty and will instead face full duties.

US government announces executive order aimed at stopping de minimis imports. See what will and won't change for US importers.

US consumer expectations have continued to evolve each year. We've pulled the latest research and surveys regarding US consumer buying preferences specifically around the desire around 2-day and same-day shipping preferences.

Rates continue to skyrocket, containers are nowhere to be found, and consumer spending keeps on rising, leading some to ask not when it will end, but if.

Based on the latest insights from the 2025 National Trade Estimate Report, here’s a practical breakdown of the most pressing trade challenges across the United States’ top 10 goods trading partners.

We examine how US-China trade tariffs have affected freight and logistics around the world.

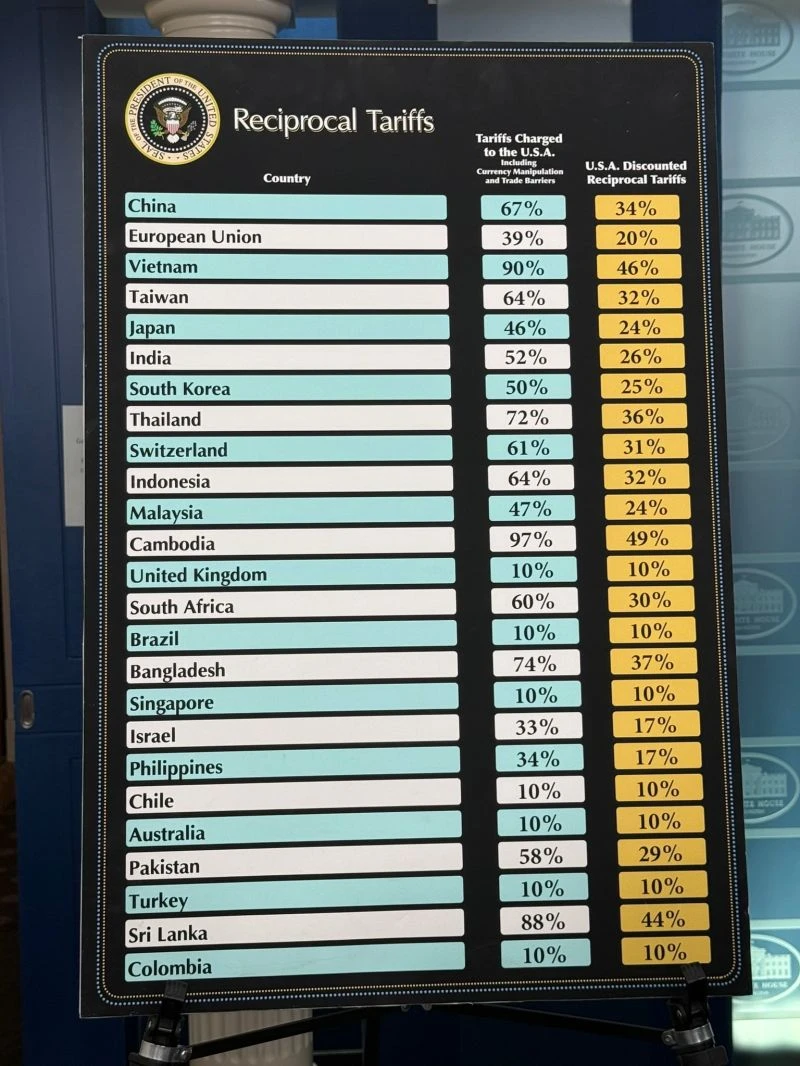

On April 2nd, the Trump administration announced reciprocal tariffs aimed at 50 countries and a baseline 10% tariff on all imports to the US. Here are the latest tariffs the US plans to levy against other countries.

This blog explores digital air freight and how e-bookings provide a more efficient and faster way for logistics professionals to make connections.

Freight Right is now offering direct consolidated ocean shipments to the Port of Long Beach and Los Angeles.

A list of strict ATA Carnet accepting-countries and the specifications they hold. Most non-commercial, exhibiting importers and exporters recognize the value and role of ATA Carnets in the complicated field of trade. While the World Customs Organization

The International Longshoremen's Association began their strike October 1, 2024, affecting ports running along the east coast and Gulf regions of the United States. See what ports are affected and what this strike can mean for shippers.