Behind every Buy Now button lies an intricate journey: from raw materials transforming into products in China within 30-60 days, to ocean voyages lasting 14-50 days, and swifter air freights that span 1-11 days but come at a premium. Once stateside, items spend a final 1-14 days journeying from local centers straight to your home. Dive in to discover the epic tale behind each purchase.

Key Takeaways:

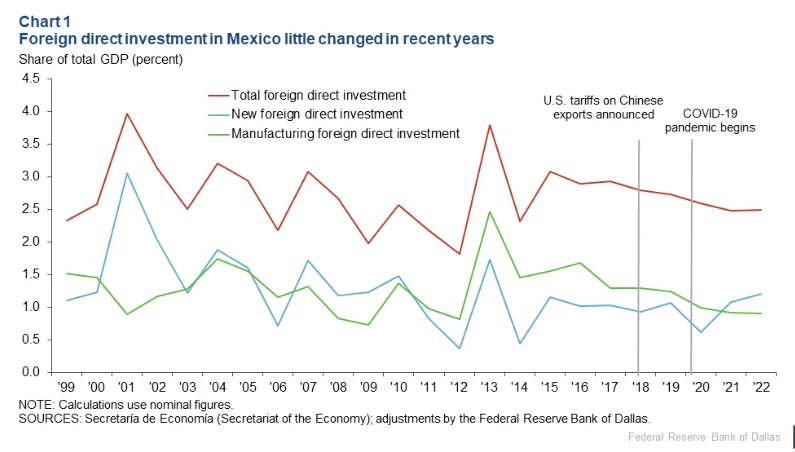

Investment in reshoring & friendshoring, particularly for Mexico, don’t appear to be materializing. Foreign investment for manufacturing capability development is flat and slightly declined YoY to ~1.5% total GDP.

About 3% of all global emissions come from global shipping according to one recent study by the United Nations, underscoring the need for the adoption of green shipping in the near future and beyond.

The emissions by high seas shipping has been increasing approximately 7.26% per-year by one study by the National Science Review’s estimation.

Climate change, inclusive of but not limited to droughts in key shipping lanes like the Panama Canal like we’ve been experiencing this year, changes to storm patterns and strengths and what ports can be affected by those changes, estimates that the costs to the shipping industry without meaningful upgrades and adaptation can cost upwards of $25 billion dollars by the end of the century according to the Environmental Defense Fund.

The market for digitization of the ocean shipping and broadly the freight industry is expected to reach a valuation of 423.4 billion dollars by 2031. Digitization inclusive of solutions around Internet of Things, supply chain visibility, container visibility technology solutions, advancements in pricing and more.

Introduction

Why US/China Trade Relations Are Important

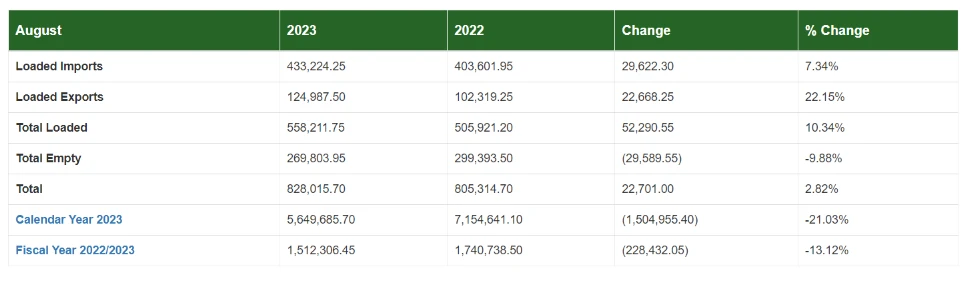

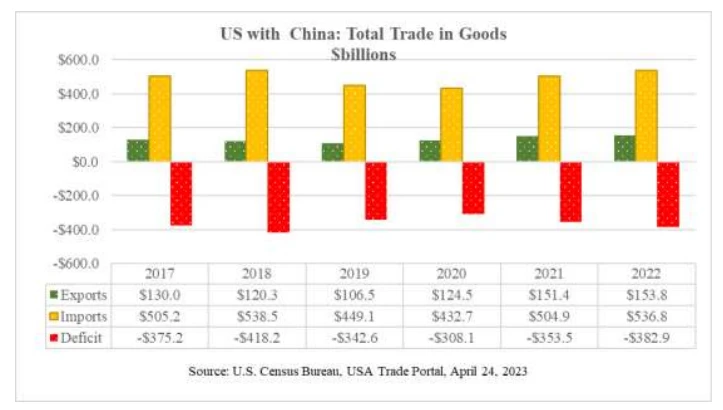

The trading relationship between the US & China is one of the most significant relationships in the world. According to the US Department of Commerce, both U.S. exports to China and imports from China grew for a third year:

US exports totaled $153.8 billion, an increase of 1.6% ($2.4 billion) from 2021;

US imports from China totaled $536.8 billion, an increase of 6.3% ($31.8 billion); and

The trade deficit with China was $382.9 billion, an increase of 8.3% of ($29.4 billion)

Additionally, the report found that in 2022, 7.5% of total U.S. exports of $2.1 trillion to the World were exported to China, 16.5% of total US imports of $3.2 trillion were imported from China, and 32.4% of total US trade deficit was with China.

For another year, China maintained the position as the US’s third-largest trade partner and most significant import origin. What they trade between them is significant. The US is the largest exporter of semiconductor technology, agricultural products, aircraft, gas turbines, and advanced medical devices to China. Conversely, the US is China’s largest import partner, importing consumer electronics, appliances, clothing, footwear, furniture, toys and other consumer goods.

The amount of importing and exporting volume between the two countries is not an equal relationship in. China exporting more than three-times the amount of goods to the US than China is importing from the US has been a longstanding point of discussion when talking about the trade relationship with China. The gap in volume of import and export activity is a trade deficit.

The topic itselfs not new. Lately, however, the topic has been brought more to the forefront as tensions around trade deficits and China working to reshape the terms that global trade relationships are dictated.

Decoupling and friendshoring have become big topics in the US & global supply chain discussions because the magnitude of interdependence between the two countries is a large undertaking to untangle despite the progress in reshoring into Mexico, Canada and Latin America.

Manufacturing investment in Mexico has remained flat if not declined. In 2022, foreign investment in Mexico is still around 2.5% total GDP according to the Federal Reserve of Dallas.

While these discussions are new as of the last 3 years have increased as companies have realized that the global supply chain is more fragile than previously thought, big shifts in power centers around importing and exporting are likely to be gradual over time but changes to these power centers are expected to occur.

Why Understanding Ocean Freight Shipping Matters

In the context of global trade, ocean shipping is the most important means of transporting goods and commodities around the world. It’s the heart of the global economy. According to one report on the topic of the importance of sea transit and its importance to global trade.

The United Nations Conference on Trade and Development (UNCTAD) estimates that roughly 80 percent of global trade by volume and 70 percent by value is transported by sea. Of that volume, 60 percent of maritime trade passes through Asia, with the South China Sea carrying an estimated one-third of global shipping.

Its waters are particularly critical for China, Taiwan, Japan, and South Korea, all of which rely on the Strait of Malacca, which connects the South China Sea and, by extension, the Pacific Ocean with the Indian Ocean. As the second-largest economy in the world with over 60 percent of its trade in value traveling by sea, China’s economic security is closely tied to the South China Sea.

No matter who evaluates the value of ocean freight and its importance to the global economy, everyone agrees that well over 75% of trade happens by sea:

It’s undeniable the importance of the sea in the movement of goods today as it was hundreds of years ago. Maritime shipping has tremendous benefits over other modes of international shipping like air shipping.

Ocean freight is economical

The biggest benefit of maritime shipping is how cost effective it is relative to other means of transporting goods over large stretches of space. The volume of goods and different kinds of goods from cars to toys to agricultural equipment that can be packed, stored and transported is vastly more than any airline could store and move.

Ocean freight is an efficient means of moving goods around

Most items can be moved by sea and there are few exceptions to that. The key determinant of what gets situated on a cargo ship is container space. Smaller-sized goods can be packaged together in the same container, space permitting, to fill a container, allowing for cost-sharing of the transportation services. Larger cargo can fill one or more containers, offering shippers unmatched options for breakbulk or project cargo.

Ocean freight is ideal for moving oversized, heavy and bulky cargo

A major advantage of sea freight shipping is shipping companies’ ability to handle oversized, heavy or bulky cargo – often referred to as breakbulk (above). Vehicles, equipment, construction materials, amusement park rides - anything objectively large and more falls into this category. Sometimes these kinds of cargo can be transported by road or plane provided they’re able to be broken down and their parts distributed and fitted among one or more trucks or beds, very large cargo is not a problem on many shipping vessels.

Ocean freight is safer for hazardous and dangerous materials transport

Ships are well equipped to transport dangerous cargo and hazardous materials. For many of the same reasons listed above for breakbulk movement, containers and ships can be outfitted to accommodate different kinds of materials easier than airlines or trucks.

Ocean shipping is comparably more environmentally friendly

When compared to sea shipping, air and many other forms of transportation have much higher carbon footprints. Ships provide the most carbon-efficient mode of transportation and produce fewer grams of exhaust gas emissions for each ton of cargo transported than any other shipment method. These already-low emissions continue to trend downward as technology advances, new ships come online and as liquefied natural gas (LNG)-powered options are utilized.

What This Guide Aims To Explain

The aim of this guide is to capture the full picture of the journey of goods from an origin in China to their arrival to someone’s residence or storefront in the United States. This guide will illustrate the steps taken, key terms and concepts required to gain a high level understanding of how goods move from one part of the world to a doorstep and all the moving pieces required to make that happen.

This article will explain:

How and where products become products in China

The complete import/export process including costs, transportation and more

Choosing a shipping line

Types of ocean containers

Costs of ocean freight

The role of freight forwarders

Types of warehousing

The role of third party logistics (3PL)

Last-mile delivery options

Challenge on the horizon for ocean freight

Chapter 1: Behind the 'Buy Now' Button

An overview of the journey that begins when you click "BUY" online

The moment something is bought online or requested to appear somewhere else more abstractly like a crate of shampoo or a thousand office desks, a whole network of activities engage to make sure that the item or items just purchased or requested arrive where they should by a given date.

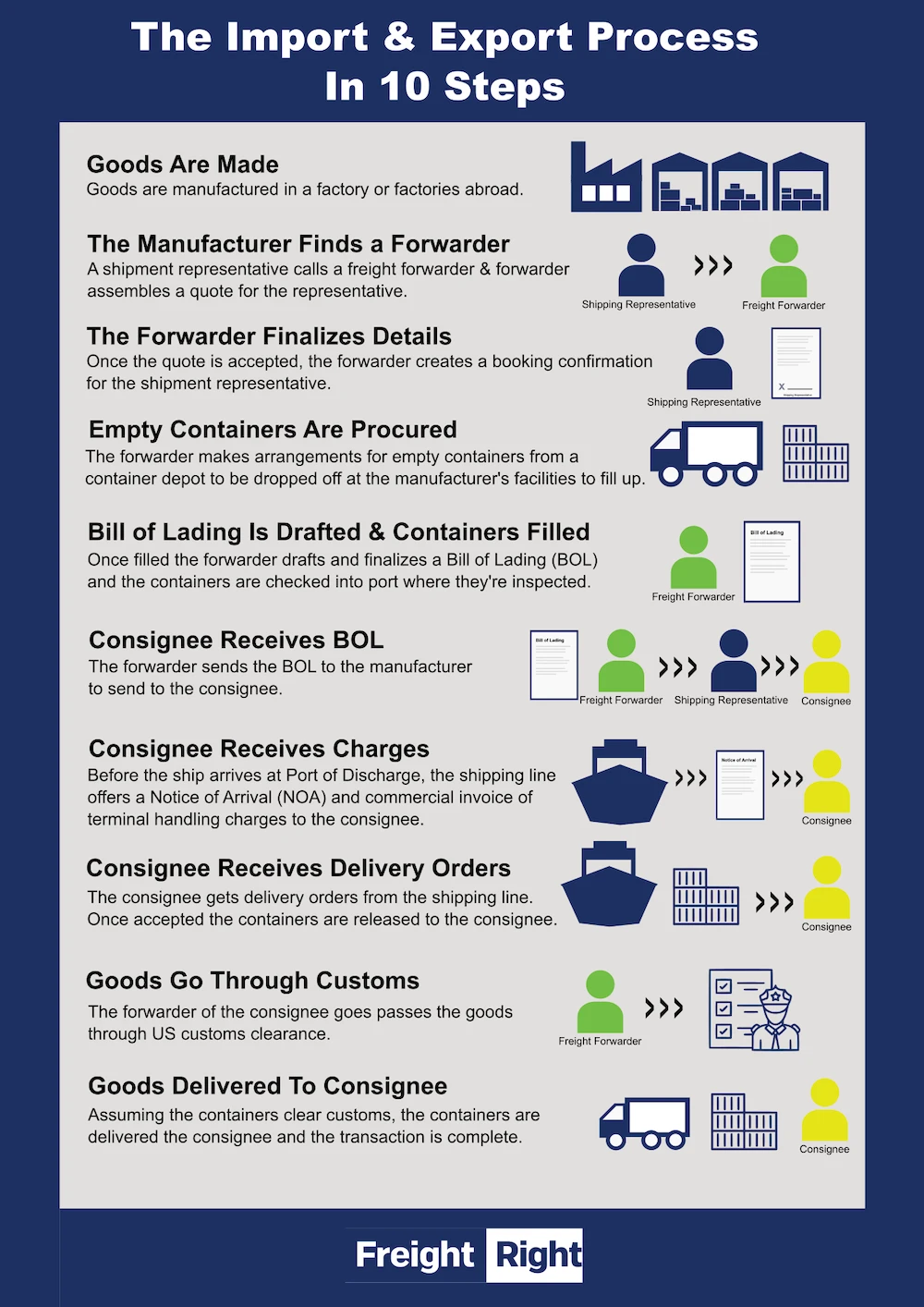

At a very high level, the means by which goods make their way from their origin to the end user, or from China to an end user in the United States for this article can be thought of like this:

Raw materials are manufactured into goods by a factory or factories in China by a manufacturer. The goods are soon-to-be-cargo.

When the cargo is ready to ship out of the factory, a shipping representative working for the manufacturer calls a freight forwarder.

The shipping rep gives information over to the freight forwarder including incoterms, port of discharge/port of export, the volume to ship, container type needed and other relevant information in order for the forwarder to put a quote together.

The forwarder then checks the current ocean container rates and shipment base and runs calculations to assemble the quote.

The freight forwarder will reply to the shipping representative for the manufacturer with a quote including information about a sailing schedule, closing time, transit time, estimated time of arrival, estimated time of delivery and total charges.

The manufacturer can then choose to accept the quote or not.

Assuming the manufacturer accepts the quote, the freight forwarder will go and make a booking confirmation and send the information back over to the shipping representative.

Once the manufacturer is booked, they'll plan the loading date with the freight forwarder and make arrangements including pick up and delivery of empty container(s) to the manufacturer. Manufacturers that don’t have special arrangements with shipping lines or other special arrangements tend to work with freight forwarders because of their knowledge of the intricacies of the process and contacts. Moreover, there is one point of contact throughout the arrangement. Freight forwarders also have the responsibility to make sure documents are properly checked and handled without errors to avoid queries by customs people or problems throughout the process for the manufacturer.

To pick up empty containers, the forwarder makes arrangements to pick up from a container depot, the place where shipping lines keep containers. Depots maintain, clean, store and fix containers. Forwarders usually visit the depot early in the morning to make sure containers are in proper condition for shipment. Manufacturers or forwarders can request grades of containers for specific projects.

Once the containers are chosen, they’re then delivered empty to the manufacturer.

The freight forwarder follows up on when to send the containers to the port of export. The forwarder follows up on a date and time to send the containers to port. Companies that ship a lot require proper discussion about shipping schedules. There’s a greater amount of coordination required around cycling empty and full containers in and out of depots and ports. Container needs to be in before closing time.

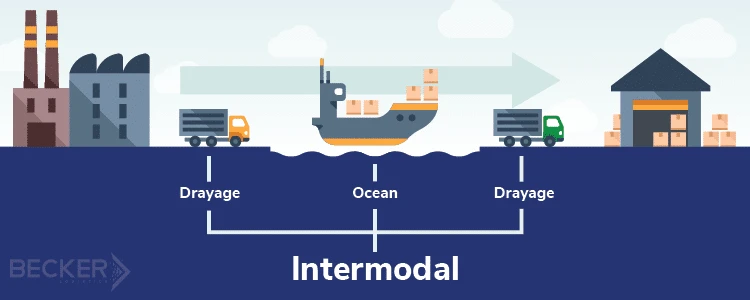

The manufacturer then fills the delivered empty containers. The process is called drayage and there are different types of drayage.

The forwarder follows up on instructions from the manufacturer to draft the bill of lading.

Once the container(s) gates into port, the forwarder needs to make sure Verified Gross Mass (VGM) and customs declaration are complete before the vessel departs. There are also checks before containers can get into port. Many containers are being collected by port all day everyday. There needs to be enough time to load and unload before the ship leaves.

The total weight of the container needs to be controlled and is checked by port professionals. Cargo weight must be evenly distributed within the container for risk that the gantry lifting it unexpectedly shifts the cargo in the container and damages it.

The forwarder then needs to follow up finalizing the bill of lading from the shipping line once the ship has departed and send that to the manufacturer.

The manufacturer will send the bill of lading to the consignee, the person or company to whom the goods and documents are being sent to, when payment has been made. Payment and bill of lading are usually sent via usually sent by DHL or Fedex.

Before the ship arrives at port of import/port of discharge, the shipping line offers notice of arrival and commercial invoice of terminal handling charges to consignee.

The consignee gives the bill of lading to the shipping line to exchange for delivery orders. The consignee are paying terminal handling charges and local charges to handle delivery orders.

Once the consignee gets delivery orders from the shipping line, the shipping line agrees to release containers to the consignee.

The forwarder of consignee goes to customs clearance and arranges for the customs to be evaluated, needing a bill of lading, commercial invoice, packing list and certificate of origin if any.

Once the container(s) is/are delivered to the consignee, the journey and transaction are complete.

The process, from origin to end user, is lengthy and complex, demanding tremendous amounts of coordination between lots of different groups of people working collectively on very precise deadlines and handling delays and issues as they arise. Every business has a goal to create the most efficient supply chain to pass the savings onto the customer to make more sales. You can see the most efficient supply chains in action at stores like Walmart and Target. It’s no wonder the logistics and supply chain industry is an over $8 trillion dollar industry by some estimates.

Overview of Supplier Contracts and Terms

Terms of engagement between a supplier/manufacturer and a business are very important to making sure the supplier builds, stores and transacts goods and interacts with other members of a company’s supply chain in a compliant way. It’s the glue that helps hold these complex, often multinational relationships together.

Supplier contracts or supplier agreements are pivotal in business operations. These kinds of agreements are legally binding agreements that define the terms of engagement between organizations and their suppliers. Agreements can cover and adjust to cover many different situations and stipulations but generally most supplier agreements will cover these major points.

Specific Offer: A clear statement of what the supplier commits to provide and what they won’t provide.

Consideration: The exchange of value between parties, often involving payment for goods or services.

Acceptance: The agreement by one party to the specific offer presented in the contract.

Intention to Create Legal Relations: Both parties acknowledge the contract's legally binding nature.

Legality of Purpose: Ensures that the contract's obligations comply with applicable laws.

Non-Disclosure Provisions: Protects confidential information shared between the parties.

Liability and Indemnity: Specifies how financial losses or legal challenges resulting from the supplier's actions will be handled and by who.

Jurisdiction and Applicable Law: Determines which legal framework and what governs the contract and how disputes will be resolved.

There are several different kinds of agreements. How, when and in what capacity they’re drawn up and used can vary from relationship to relationship. Below are some of the major kinds of agreements suppliers and companies will engage in:

Exclusive Agreement: One supplier is granted the sole rights for raw material or product supply.

Non-exclusive Agreement: Multiple suppliers are employed for raw material or product provisioning.

Purchase Agreement: A standard contract for procuring goods or services. Purchase agreements cover pricing, quantities, delivery schedules, quality standards, payment terms, and dispute resolution.

Manufacturing Agreement: This agreement is typically relevant when outsourcing manufacturing to a supplier. It tends to cover product specs, production processes, quality control, pricing, delivery schedules, intellectual property, and confidentiality of product manufacturing.

Service Level Agreement (SLA): Utilized for service-based supplier engagements. Specifies services, performance metrics, response times, penalties for non-compliance, and key performance indicators. Typically not used if there’s material goods like chairs or toys involved.

Distribution Agreement: Pertains to product distribution rights within a designated region or market. The agreement defines roles, exclusivity, sales targets, marketing support, and clauses around termination.

Outsourcing Agreement: Deployed when outsourcing specific business functions. The agreement breaks down scope, performance expectations, pricing, service levels, confidentiality, liability, transition plans, and termination situations and clauses.

Master Supply Agreement (MSA): Establishes overarching terms for future transactions. Includes pricing, order placement, product specs, warranties, intellectual property, confidentiality, termination, and more.

Non-Disclosure Agreement (NDA): Safeguards confidential information shared during the business relationship. Ensures the supplier maintains confidentiality and refrains from unauthorized disclosures.

Framework Agreement: Sets a foundational framework for future deals. Defines terms and conditions governing subsequent specific agreements, including pricing, delivery terms, quality standards, and dispute resolution mechanisms.

Which agreements are in place with what business or what supplier(s) is something usually entirely out of the vision of the end user. The terms of the contract and what the contracts are, usually, will help businesses ensure parts of their engagements with suppliers are guaranteed and predictable. So much so that companies can know with near certainty what costs will be incurred, where and how such as to properly forecast pricing and delivery availability throughout the supply chain.

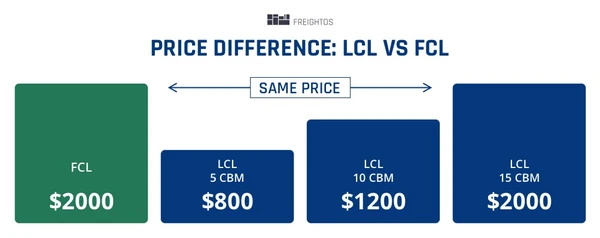

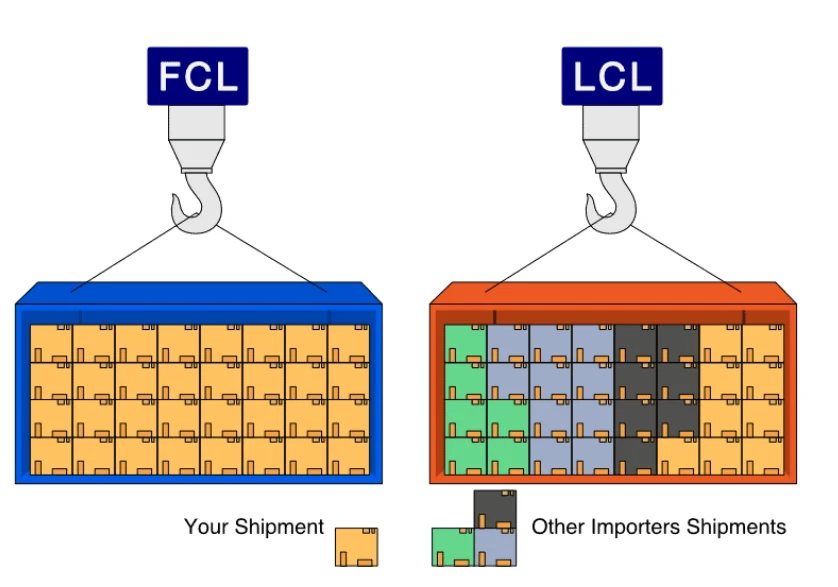

This table breaks down the key uses for when a shipper would consider using FCL and/or LCL:

Shipping Costs During Export & Import

Costs can vary between services required to complete the journey. Major expenses, including these below can vary tremendously but as a benchmark, these figures can be helpful in understanding what costs are involved in moving goods from China to the US:

Factory to port transportation costs can vary widely depending on the port of export, the cargo being transported and if the order is for FCL or LCL.

Export clearance in China costs include and can range from:

Customs Clearance Fee can be around $75-$95/shipment

EDI Fee: around $10/shipment

Documentation Fee: around $50-$75/shipment

Handling Service Fee: around $50-$75/shipment

AMS Fee: around $25-$30/shipment

VGM Fee: around $15-$25/shipment

The insurance company can be 2-6%. One estimation of the insurance costs can be calculated using this formula: ((Commercial invoice value + freight charges) +10% )+(Commercial invoice value + freight charges) = Insured value

For high value cargo, the shipper would need to get a rate directly from the cargo insurance company’s underwriter

Document delivery costs can and often include one flat fee, $35-50, on top of other costs.

Port charges in the US can vary for the same reasons as exporting goods above as well as if they’re inclusive of any of these other possible costs:

Customs Clearance Fee

Customs Duty (Destination)

PierPass Charge

Alameda Corridor Surcharge (ACS)

Demurrage and Detention / Warehouse Fees

Telex Release/EDI Fee

Delivery Fee

Chassis Usage Fee

Container Cleaning Fee

Customs bonds in the US can vary depending on the type of bond:

Annual Bond: around $400-$500

Single Entry Bond: around $65 dollars

Costs can also change depending on the incoterm in effect.

Incoterms are used to define which organization has responsibility and liability for goods during the life of a shipment. Each term denotes a different stage of ownership. The terms spell out when responsibility for the goods transfers from the supplier to the buyer. They also define who pays which costs for the goods and their transport.

Transportation to the Port

Assuming that the manufacturer has accepted the freight forwarder’s quote, the next step will be to move the manufacturer’s goods out of their facilities and to the port of export.

To do that, empty containers will need to be drayaged out of a nearby container depot and delivered to the manufacturer. During deliberations the forwarder and manufacturer likely discussed specific types of containers, dimensions, materials or if the containers needed to be able to handle special materials like refrigerated or hazardous material. The forwarder handles the coordination of booking the empty containers and their delivery to the manufacturer’s facilities.

Once the containers arrive, they’re then filled up, reloaded to trucks and sent over to the port of export’s warehouse for storage until their shipment date or sent right to port.

A forwarder would have also secured the shipping line, date of departure and clarified estimated date of arrival, departure and other important information for the manufacturer.

Port costs can vary. It’s difficult to provide a range of what costs a shipper can expect to pay because costs are usually tied to the port, lane and goods being shipped on top of other details like whether there is a premium added on for faster delivery.

via: https://www.beckerlogistics.com/wp-content/uploads/2020/10/Intermodal-and-Drayage-Trucking-Process-01.png

If everything is set up without any issues, confirmation is the last paperwork step. A booking confirmation is the document issued by the freight forwarder to the manufacturer.

The booking confirmation contains all the basic shipment details such as:

Cargo type

Total cost/quoted costs

Cargo weight, volume & dimensions

Packages (pallets, etc.)

Location collected from

Location delivered to

Routing information

Shipment ID

Shipper name & information

Consigner name & information

Carrier booking reference ID

Bill of Lading

and other important information about the booked shipment and the contents.

The booking confirmation documents help parties including the consignee, the shipper, and the buyer finish the transaction with the bank. The booking confirmation number is often used as the main shipment tracking code.

Booking confirmation and Bill of Lading can be thought of as receipts for the booked container. There is likely other documentation that can and should be included as part of the full package of documents associated with a container.

The volume of documentation is usually something that causes shippers a lot of headaches and document management in logistics is its own set of skills. Freight Right’s Visibility tool is designed to help shippers better manage documents associated with their containers and shipments.

Bill of Lading (B/L): B/L is a document that serves as evidence of the contract of carriage between the shipper, the carrier, and the consignee. It contains details about the cargo, the vessel, the ports of loading and discharge, and the terms and conditions of the shipment.

Packing List: A packing list provides a detailed inventory of the contents of the container, including the quantity, description, and weight of each item. It helps in verifying the cargo's contents upon arrival.

Commercial Invoice: This document includes information about the buyer, seller, and the terms of sale. It specifies the value of the goods, currency, payment terms, and any other relevant commercial details.

Certificate of Origin: Some shipments may require a certificate of origin to prove where the goods were manufactured. This document is essential for customs clearance and compliance with trade agreements.

Certificate of Insurance: If the goods are insured during transit, a certificate of insurance may be included in the shipping confirmation. It provides details about the insurance coverage and the insured parties.

Customs Documentation: Depending on the destination country, various customs-related documents may be included, such as import permits, licenses, or certificates required for clearance.

Booking Confirmation: This document confirms the reservation of space on the vessel and provides information about the shipping schedule, container number, and loading details.

Arrival Notice: An arrival notice informs the consignee or the receiving party about the impending arrival of the shipment. It includes details like the estimated arrival date, port of discharge, and container information.

Hazardous Goods Declaration/Shipper's Declaration for Dangerous Goods: If the shipment contains hazardous materials, a declaration stating the nature of the hazardous goods and compliance with safety regulations is included.

Inspection Reports (if applicable): In some cases, inspection reports may be part of the shipping confirmation, especially if the goods underwent inspection before shipment.

Delivery Order: A delivery order is issued by the carrier or their agent, authorizing the release of the cargo to the consignee or their representative. It is crucial for taking possession of the goods at the destination.

Weight and Measurement Details: Information regarding the weight and dimensions of the container and its contents is typically included.

Special Instructions (if applicable): Any specific handling or delivery instructions may be provided as part of the shipping confirmation.

Tracking Information: Many shipping companies provide tracking details that allow shippers and consignees to monitor the shipment's progress in real-time.

Chapter 2: Ports of Departure: China's Oceanic Gateways

Major Chinese ports involved in US trade (Shanghai, Shenzhen, etc.)

China has over 150 major ports and over 1800 minor ports dotting their coastline. There is no shortage of points for China to send goods out of or intake goods into the country. China has invested around $11 billion dollars in its port infrastructure to handle the shipping volume.

Many countries, like Mexico, in the last 3 years have made significant investments in their port infrastructure as a means to make their shipping operations an attractive alternative to countries looking to decouple their import/export activities from China but those investments are young and come with their own set of political and geographic challenges that China doesn’t have.

Though there are hundreds of ports in China, at time of writing this 7 of the 10 ports handling the most TEUs (define) per day are in China.

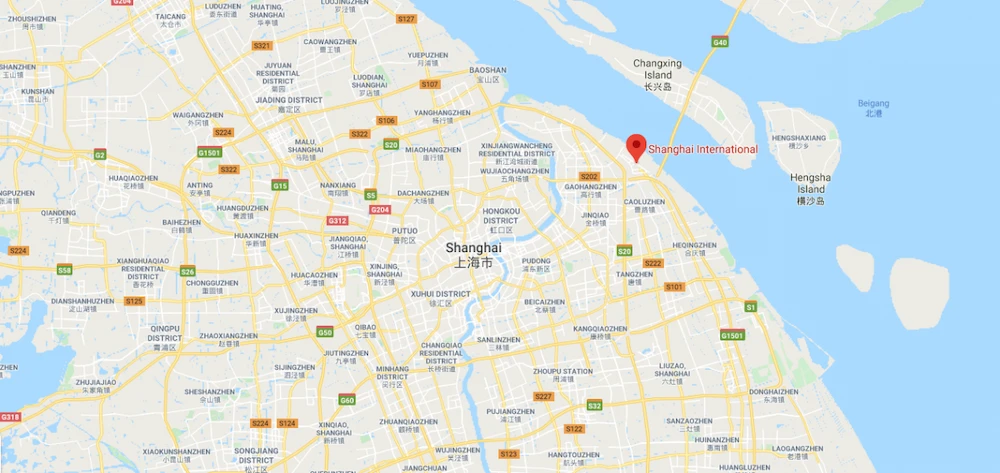

Port of Shanghai (SIGP)

The port that holds the number one spot for the highest volume of TEUs is Port of Shanghai.

As of 2021, Port of Shanghai has handled 47.03 billion TEUs. Singapore, the second highest volume port in the world handled about 10 billion TEUs in 2021, 37.49 billion.

The Port of Shanghai was founded in 1842 near the East China Sea, at the mouth of the Yangtze River. Port of Shanghai has numerous terminals, but some of the major terminals at the include:

Yangshan Deep-Water Port: One of the largest and most modern container terminals at the Port of Shanghai, located on Yangshan Island. The Yangshan Deep-Water Port handles over 40 million TEUs annually. Notably, it is one of the world's largest automated container terminals, enhancing efficiency and reducing emissions.

Waigaoqiao Port: Waigaoqiao is a key part of the Shanghai International Shipping Center and consists of several terminals, including Waigaoqiao No. 3, which is primarily dedicated to containers.

Yangshupu Port: Yangshupu is an important general cargo port on the Huangpu River, handling various types of cargo, including steel and bulk goods.

Wusongkou International Cruise Terminal: This terminal is designed for cruise ships and passenger vessels, serving as a gateway for tourists visiting Shanghai.

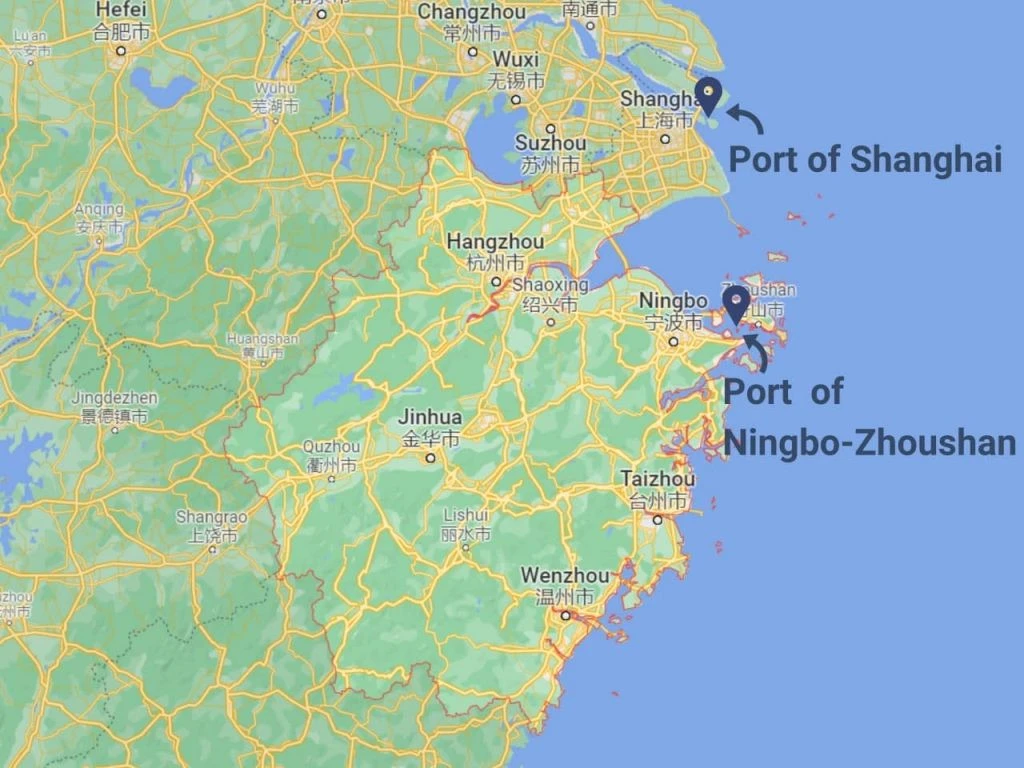

Port of Ningbo-Zhoushan (CNTAO)

The Port of Ningbo-Zhoushan was officially founded in 2006 through the merger of the Port of Ningbo and the Port of Zhoushan.

It is located near the East China Sea, at the confluence of the Yangtze River and Hangzhou Bay. Some of the noteworthy terminals in Port of Ningbo-Zhoushan include:

Ningbo Beilun Port

Ningbo Daxie Development Zone Port

Zhoushan Dinghai Port

Ningbo Zhenhai Port

The Port of Ningbo-Zhoushan is known for handling a wide range of cargo, including containers, bulk cargo (such as coal and ore), general cargo, and oil products. The port is significant particularly because of its proximity to the Yangtze River Delta.

Port of Shenzhen (CNSEZ)

The Port of Shenzhen, officially known as the Shenzhen Port Group, consists of multiple terminals and areas along the Shenzhen River. There is no one port that makes up the Port of Shenzhen with different founding years and establishments.

The collective Port of Shenzhen is in the southern part of Guangdong Province along the coastline of the South China Sea in the southern part of the Pearl River Delta.

The Port of Shenzhen comprises several terminals and areas, including:

Shekou Container Terminals

Yantian International Container Terminals

Chiwan Container Terminals

Dachan Bay Terminals

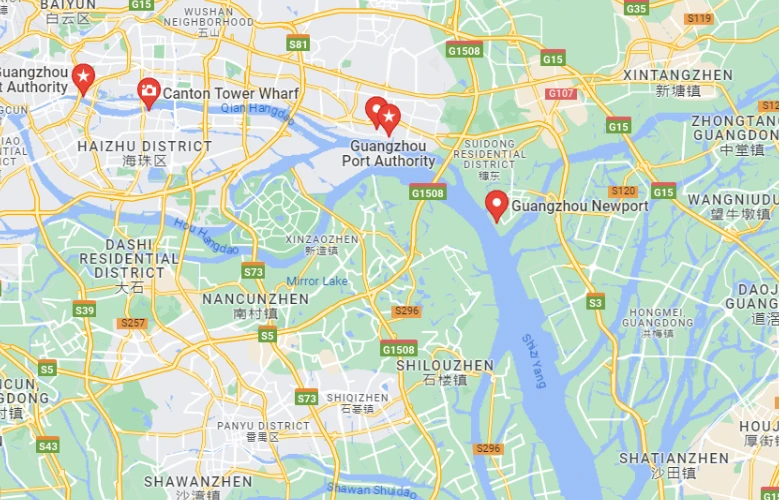

Port of Guangzhou (CNCAN)

The Port of Guangzhou, also known as the Port of Canton, has a long history dating back over 2,000 years. It is one of China's oldest and most important ports, with its origins in the Qin Dynasty (around 221 BC).

via: https://www.gzport.com/enweb/foreground/EN

The Port of Guangzhou is also located near the Pearl River in southern China, providing access to the South China Sea.

Some of the busiest terminals at Port of Guangzhou include:

Nansha Port

Huangpu Port

Xinsha Port

Port of Qingdao (CNTAO)

The Port of Qingdao, also known as Qingdao Port, has a history dating back to 1892 when it was established as a trading port during the Qing Dynasty.

via: https://maritime-executive.com/editorials/qingdao-china-s-iron-gateway-to-the-arctic

The Port of Qingdao is located on the Yellow Sea, providing access to the Bohai Sea and the broader Pacific Ocean. The Port of Qingdao consists of several terminals and areas, each specializing in different types of cargo. Some of its key terminals include:

Qianwan Container Terminal (QQCT)

Lijin Petrochemical Terminal

Huangdao Oil Port

Dongjiakou Port

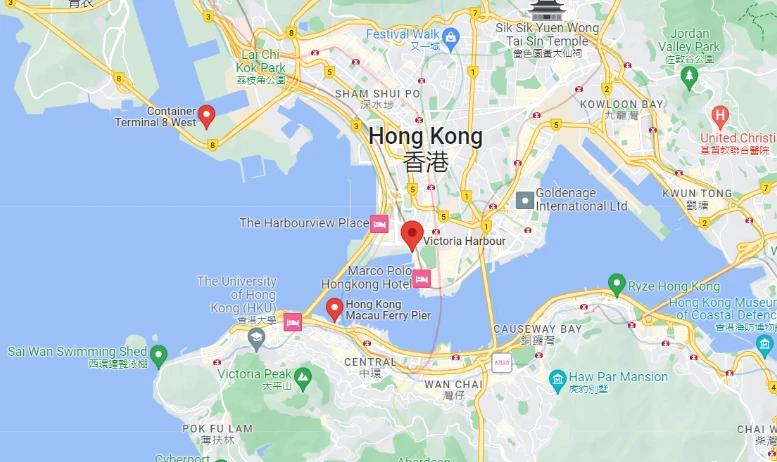

Port of Hong Kong (HKHKG)

The Port of Hong Kong, one of the world's busiest and most prominent ports, has a history that dates back centuries. It served as a trading hub well before British colonization in the 19th century. However, in its modern form, the Hong Kong Port as we know it today developed during British colonial rule.

via: https://www.hkmpb.gov.hk/en/port.html

The Port of Hong Kong is strategically located on the South China Sea, near the Pearl River Delta and the port provides access to the South China Sea and the broader Pacific Ocean.Some of the key terminals include:

Kwai Tsing Container Terminals: This area houses multiple container terminals, including Kwai Chung Container Terminal, Tsing Yi Container Terminal, and others.

Hong Kong International Terminals (HIT)

River Trade Terminal

Hong Kong International Airport: While not a traditional seaport, it is closely linked to cargo transportation and is vital for airfreight.

Most goods arriving in the United States, whether toys, iron ore, furniture or agricultural equipment, are likely coming from one of these ports.

Choosing a Port

Choosing a port for your goods to leave from is unquestionably critical. There are hundreds of shipping lines going from China to the US and a balance of cost, time and efficiency to consider.

Selecting the appropriate port for your shipments holds considerable sway over your supply chain. It's imperative for shippers to scrutinize various factors before settling on a port. Making changes when plans are finalized is certainly possible to do and does happen but usually will come with additional costs from the freight forwarder or shipping line to accommodate.

Below are some of the major factors typically taken into consideration when choosing a port:

Port Location

The first aspect to weigh is the port's location. Shippers need to consider proximity to shipping and delivery points and how the proximity translates to cost savings because of the accessibility and reduced transportation expenses.

Port Infrastructure

The infrastructure and equipment within a port exert a direct influence on cargo handling efficiency and safety. Elements like navigable channels, berthing for large vessels, and strong connections between shipping lines and port operations are pivotal for seamless transport. This aspect pertains more to how efficiently goods move around the port which can translate to reliability and handling safety.

Availability of Different Transportation Options (Ground, Air, etc.)

The availability of land transport options within and around the port is pivotal. Major ports occasionally confront service disruptions due to strikes or expansion initiatives, prompting consideration of smaller, slightly distant ports that can improve safety and reduce cargo handling durations.

Customs Procedures

Customs procedures can vary substantially from one port to another. Certain ports process specific customs processes faster than others which can make them preferable for particular cargo categories such as vehicles or international removals.

Port Size

Port size is perhaps the biggest factor to consider. Larger ports boast a greater array of carriers and vessels, translating into more direct services and improved transport management efficiency over smaller ports. This factor influences both facility capacity and carrier costs.

Ease of Tracking Shipments

Modernization and digitalization in the shipping industry have ushered in enhanced transparency in booking and shipment tracking. Advanced ports have introduced automated gate-in procedures with biometric identity verification systems, and other technologies to reduce the risk of misplaced containers, unauthorized people at ports and other things that can cause delays or worse damaged goods that can’t be shipped.

Congestion at Ports/Likelihood for Delays

Port congestion looms as a substantial challenge in maritime logistics. This issue arises when vessels encounter delays in berthing, often during peak seasons, prompting shippers to explore alternative solutions.

All ports experience some kind of delays and accounting for delays at time of booking can be the most challenging as it’s the least predictable but it is something to keep in mind if a port has a reputation for congestion, labor shortages or other things that lead to delays.

Customs Procedures in China

Exporting goods from China is a common area issue that can emerge for shippers and companies. Understanding the full scope of how Chinese export customs procedures work can be a daunting task and, again, usually one a forwarder or customs broker will better know the ins and outs of and can advise accordingly.

An essential document in China's export process is the export license. This document grants suppliers permission to export specific goods, particularly crucial for hazardous or prohibited items.

An export license is a document that compiles information about the exporter, the buyer, the cargo, the value and the mode of transportation.

The validity time of an export license depends on the delivery date that is established in the contract. Usually, an export license expires about six months after it is issued. An exporter can apply for a two-months overtime if the goods are not exported during the license validity time.

Without such an export license, your cargo will not be cleared through the Chinese customs.

It’s important to be familiar with China's Export Prohibited and Restricted Technology Catalog. This collection of information outlines bans 33 technologies from export without government licenses. These technologies mainly pertain to telemetry coding, encryption software/hardware, artificial intelligence, cryptography, security tech, and advanced defense technology.

Pre-Shipment Inspections

In addition to export customs, China’s pre-shipment inspections (PSIs) are the step to make sure that the exported goods.

China formally adopted pre-shipment inspections in 1994. Starting that year, pre-shipment inspections were formally implemented as part of an accord aimed at enhancing global trade standards. This agreement was established within the framework of the General Agreement on Tariffs and Trade (GATT), subsequently succeeded by the World Trade Organization (WTO).

China’s pre-shipment Inspections (PSIs) helped to establish it as a great, reliable superpower in shipping. These inspections verify that goods meet both the buyer's standards and relevant governmental regulations.

PSIs offer significant advantages to both manufacturers and buyers. They often serve as a prerequisite for customs clearance, mitigating supply chain bottlenecks and ensuring adherence to quality and safety norms.

The benefits of PSIs include:

Detecting substandard products to prevent financial losses.

Avoiding costly rework before shipping.

Ensuring product quality and safeguarding brand reputation.

Typically, PSIs take place when goods are 100% complete and 80% packed, minimizing disruptions in the supply chain.

Conducting PSIs in China may pose challenges, including lax attitudes, self-serving inspection agencies, and misconceptions about company standards. Collaborating with a reliable inspection agency is imperative.

The PSI process in China encompasses supplier visits, document signing, and comprehensive inspections covering quality, packaging, functionality, size, weight, and barcode checks. Successful inspections lead to legal certificates and detailed reports.

Below is a more detailed breakdown of aspects that China’s exports officers evaluate exports for:

On-site Inspection: Inspections occur at the manufacturing facility, potentially involving off-site lab testing for restricted chemicals.

Quantity Verification: Inspection confirms accurate quantities and proper packaging materials for payment initiation and shipment accuracy.

Random Sampling: Internationally recognized statistical methods, such as ANSI/ASQC Z1.4 (ISO 2859-1), guide the random selection of samples based on Acceptance Quality Limits (AQL).

Cosmetic and Workmanship Evaluation: Inspectors assess overall workmanship, categorizing defects as minor, major, or critical based on predetermined tolerances.

Conformity Assessment: Quality control inspectors scrutinize product dimensions, materials, labeling, and adherence to specified criteria.

Functional and Safety Testing: This step involves physical tests, fabric density checks, mechanical safety assessments, and electrical safety evaluations, as applicable.

Inspection Report: Upon completion, a comprehensive report is generated, summarizing results, key findings, and providing visual documentation for transparency.

Chapter 3: The Ocean Voyage

Types of Ocean Shipping Containers

via: https://guidedimports.com/blog/lcl-vs-fcl/

During the process of booking shipment, options will be available for Less Than Container Load (LCL) and Full Container Load (FCL) storage.

Both types of containers have their applications to shippers. The good itself being transported, and cost are two significant reasons.

This table breaks down the key uses for when a shipper would consider using FCL and/or LCL: